VIETNAM, THE UNDISCOVERED GEM YOUR PORTFOLIO MAY BE MISSING

Over the past 6 months we’ve engaged in conversations with numerous clients and a recurring theme has emerged: A growing interest in allocating funds to India. However, we believe it’s essential for investors to broaden their horizons beyond India and explore other Asian markets. While India remains an attractive investment destination, concerns about its valuation persist. As the […]

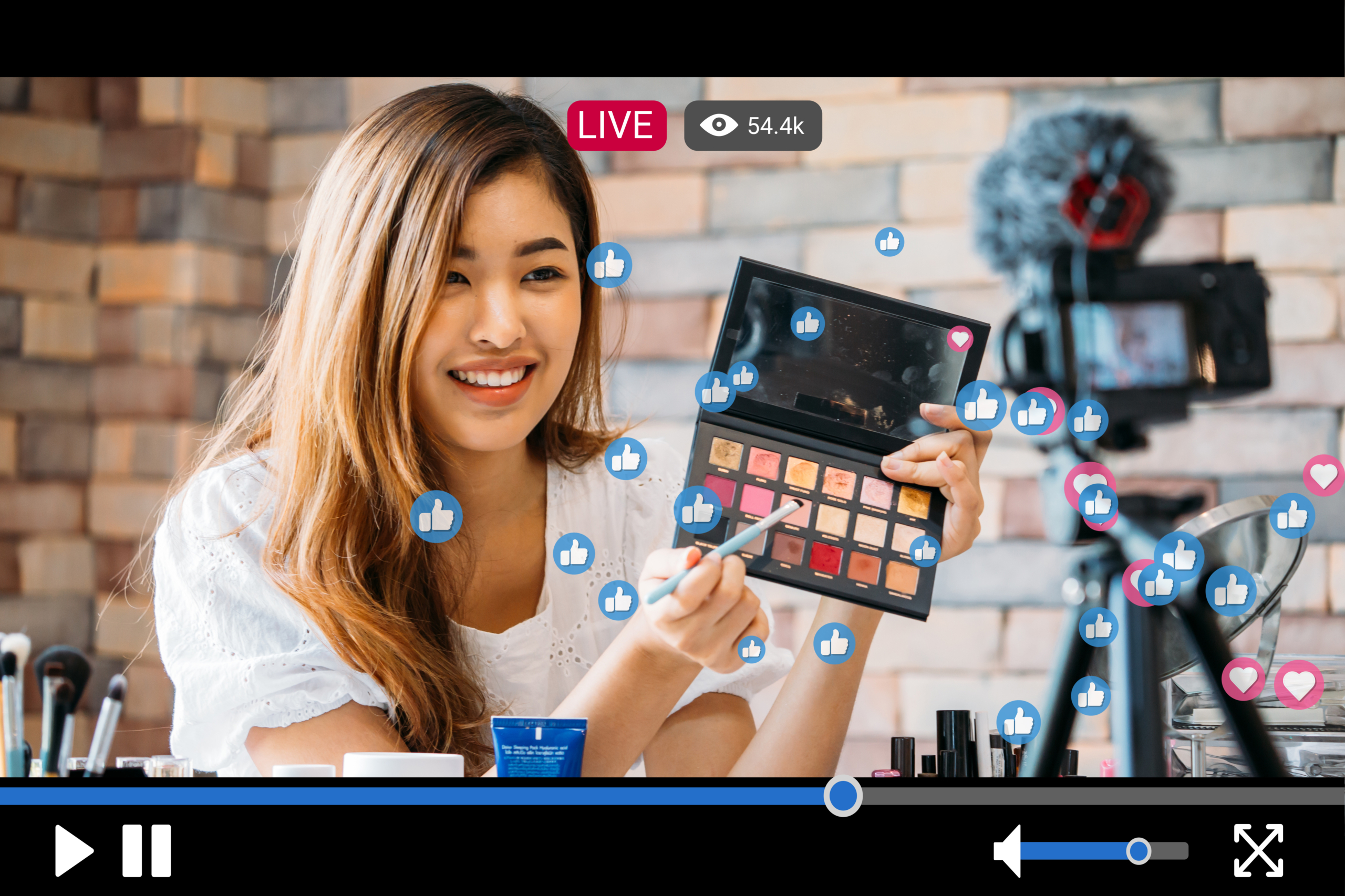

ASIA’S NEW DIGITAL CONSUMERS

Asia’s middle class digital savvy consumers are avid users of social media, leading to dramatic shifts in purchasing behaviour. The competitive landscape is becoming more dynamic and as a result strong domestic brands are emerging whilst the traditional incumbents are being disrupted.

Our recent trips to the region have drawn our attention […]

THE YEAR AHEAD – 2024

In 2023 a barrage of challenges hit growth stocks leading to a historic de-rating. However the setup for 2024 looks better with resilient Emerging market growth contrasting with rising recessionary risk in Developed markets. Supported by low valuations, encouraging growth prospects, anchored inflation, and room for interest rate cuts we are positive on Emerging market equities for 2024. […]

We welcome feedback on our reports.

We want to make sure they’re as relevant as possible to our investors.