Asia’s middle class digital savvy consumers are avid users of social media, leading to dramatic shifts in purchasing behaviour. The competitive landscape is becoming more dynamic and as a result strong domestic brands are emerging whilst the traditional incumbents are being disrupted.

Our recent trips to the region have drawn our attention to some interesting trends that are making the team Halo take a much closer look at some of our positions and potential new ideas.

We recently visited the world’s 4th most populous country 1 Indonesia and came away impressed at the pace of development we have witnessed over the course of the last decade. With a population of over 270m and a positive growth rate in its working age population, demographics is a tailwind. Indonesia’s middle-class has outgrown the other income segments and now 1 in every 5 Indonesians falls into this income bracket.2 Middle class consumers generally enjoy economic security. As consumers enter this band, they tend to have higher disposable income and increasingly turn their attention towards spending on lifestyle related categories such as sports, eating out and fashion.

Today’s middle class Asian consumer is increasingly a “digital native”, they have grown up with instant digital access to all kinds of information. Generation Z, people born loosely from 1995 to 2010 are set to drive consumption in the coming decade. This cohort is a heavy user of social media to consume content, play games and create connection. McKinsey research has found that 20-30% of Generation Z spend over 6 hours per day on their mobile phones consuming video content3. The heavy use of social media and other digital content is shaping the way consumers engage with and eventually purchase products.

Tik Tok has taken Southeast Asia by storm with over 325m visitors to the app every month. Indonesia is the Chinese company Tik Tok’s second largest market globally with 125m users after the US, according to the company. In Vietnam it has become the number 2 e-commerce platform after Shoppee4, despite launching only a year ago. Vietnam is expected to add 36m people to the middle class in the next 10 years 5 and with an estimated 55% of Generation Z using Tik Tok5, the app is becoming hugely influential in driving purchase behaviour. Southeast Asia seems to be more receptive to the platform’s tailored, viral content and digitalisation is causing consumers to leapfrog the traditional development model where “un-organised/mom & pop stores” get replaced by modern retail. The rapid development of e-commerce has transformed consumer behaviour. Brick and mortar stores are no longer essential for product experience. Traditional barriers, like extensive distribution networks are shrinking. We are witnessing a new wave of direct-to-consumer business models emerging like Mamaearth (Honasa Consumer in India) which in only 8 years is now generating annual revenue of over USD $200m.

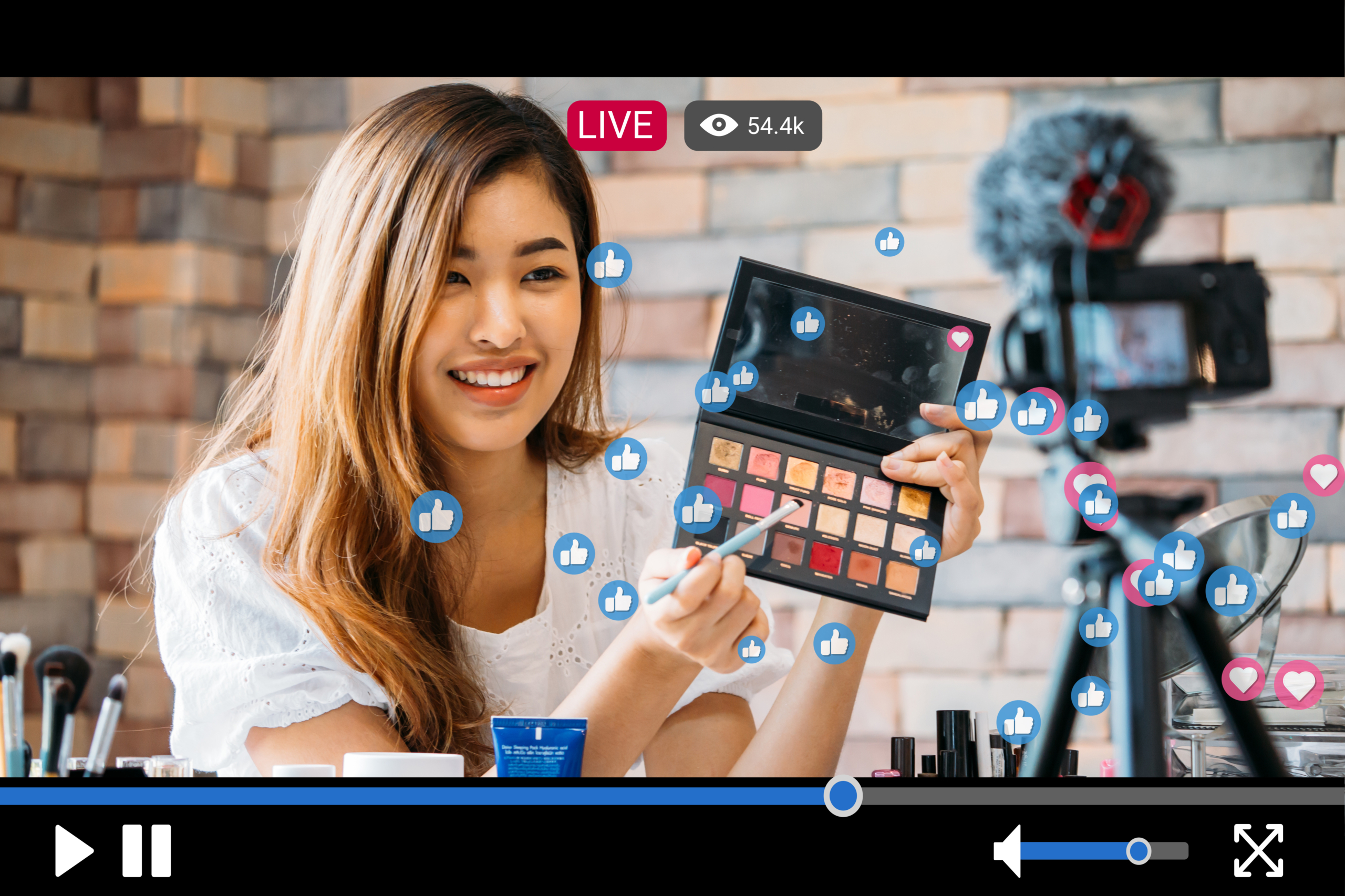

As social media platforms like Tik Tok get more users, they become increasingly more powerful in being able to influence consumer behaviour. In Asia we are witnessing purchase decisions increasingly being driven via live-streaming platforms like Tik Tok or Douyin in China. The increased popularity of these platforms has led to the emergence of “influencers” or Key Opinion Leaders (KOL’s) in Asia. The huge popularity of these influencers is due to the customer perception of authenticity and trust. Consumers value the opinion of knowledgeable influencers. Influencers such as China’s Liptstick King, real name Li Jiaqi has amassed a staggering 75m followers on Taobao Live, Alibaba’s live streaming platform. The interactive nature of social media means influencers can trial products, create tutorials and interact live with consumers. The medium really lends itself to the skincare and beauty categories and the huge followings certain influencers have gathered, has meant they possess enormous power when it comes to directing consumer purchases.

The rise of social commerce has created new opportunities and challenges for both domestic and international companies. We are seeing domestic skincare brands like Proya in China, gain market share in an industry where many international premium brands are starting to struggle. Companies that are winning in this new arena are those that can build local communities and effectively engage customers. We are seeing local companies such as Proya in China and Victoria Care in Indonesia exhibit remarkable agility when it comes to launching new products. They can direct R&D and sales efforts to areas where they see surging demand and capitalise on the fervour. In 2021, for International Women’s Day, Proya partnered with the state run China’s Women’s daily on a 2-minute video challenging gender stereotypes. The related hashtag, “its prejudice not gender” was read over 100 million times.6

To conclude, the new environment of social commerce demands agility from both domestic and international brands. We are seeing that the companies who succeed in this environment are those that can respond quickly to the changing needs and preferences of their customers, as well as the competitive landscape of the market. Asian consumers previously viewed global brands as more innovative, reliable, and prestigious. However, this perception is now being disrupted by the rise of highly innovative domestic brands that effectively leverage social media. As a result, we are witnessing a shift in the landscape with some new winners and losers. Local players like Anta in China, MamaEarth in India and Masan in Vietnam have built hugely successful brands. This new generation of consumers is hyper-connected, well-informed and increasingly demanding. They expect more from their brands even at lower price points leading to a dynamic and competitive environment which in turn leads to an evolving balance of power between global and local brands.

We see increasing opportunities for investment as well as challenges for incumbents in this dynamic environment. Strong domestic champions are emerging and the Halo fund offers exposure to a number of these rising stars.

- https://www.statista.com/statistics/262879/countries-with-the-largest-population/

- Aspiring Indonesia: Expanding the Middle Class (worldbank.org)

- The trailblazing consumers in Asia propelling growth | McKinsey

- TikTok Shop emerges as second-largest e-commerce platform in Vietnam | Tuoi Tre News

- The new faces of the Vietnamese consumer | McKinsey

- Chinese women’s group video challenges government’s idea of a real man | CNN

To download the article as a PDF, click here.