In 2023 a barrage of challenges hit growth stocks leading to a historic de-rating. However the setup for 2024 looks better with resilient Emerging market growth contrasting with rising recessionary risk in Developed markets. Supported by low valuations, encouraging growth prospects, anchored inflation, and room for interest rate cuts we are positive on Emerging market equities for 2024.

This last year has been challenging for growth stocks. In 2023 the priority has been to shift to higher yielding assets or AI in developed markets and steering away from deploying capital in Asian markets. In the past two years, there has been a tendency to emphasize income and value style investments whilst moving away from growth-orientated equities. As a result, investment styles that prioritise quality growth, like ours, have become less popular. However, as we move into 2024 generating growth is looking to be increasingly challenging in Developed Markets due to the looming risk of recessions in Europe and the US. Conversely, growth in Emerging Asian markets is likely to exhibit resilience, resulting in a widening growth gap between the two regions.When investors consider valuations in combination with growth prospects, interest rates, government fiscal spending and government leverage, then the markets we concentrate on all score highly. However, we observe an anomaly between the valuations of corporates exposed to these markets and their fundamental drivers and believe this should start to normalise during 2024.

(We have shown the relative valuation of the key ASEAN markets we currently invested in as they stand today in the country section.)Inflation in the region is looking well anchored and is on track to return to its average pre covid levels. Asian central banks, responding to rising US rates raised interest rates significantly beyond what was necessary for their economies, resulting in positive real rates across the region. Looking ahead to 2024 this means there is real potential for interest rate cuts should we see a sustained weakening of the US dollar coupled with the US Federal Reserve cutting policy rates. As a result, we believe that the stock markets in several countries are poised for a re-rating. As international investors turn their attention away from the US, markets that trade at significant discounts to their long-term average, such as Vietnam, Philippines and Indonesia should come into focus and our Fund is positioned to benefit.

China

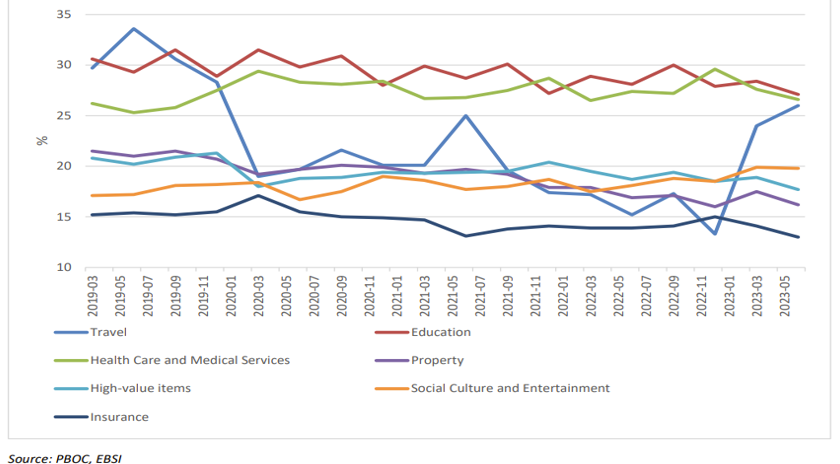

In 2024 we anticipate a year of stability with our attention centred on how China is likely to evolve beyond the reopening of its economy. We believe China can sustainably achieve GDP growth of 3-5% between now and 2030. The economy is transitioning away from its dependence on debt, reliance on property and exports, to more sustainable growth drivers such as rising middle class consumption, improved quality of life and a greater focus on higher value-added investments. As this transition unfolds over the next few years, consumption is expected outpace GDP growth.Whilst maintaining a broadly neutral stance on China we still see areas of structural growth. The tourism sector typically grows at 1.5-2x the GDP growth. Additionally outdoor pursuits are growing in popularity encouraged by government policies for a healthier lifestyle. We see structural demand for wealth management and savings type products and have positioned our portfolio accordingly to capture this opportunity.

Household spending preferences in China

ASEAN- Accelerating or resilient growth in 2024

Our outlook towards countries in the region is positive. Markets are starting from extremely depressed levels. In the case of Vietnam investigations into property developers and the corporate bond market led to monetary tightening, which began in late 2022 and continued into the first half of 2023. Meanwhile, foreign investors shifted away from the Philippine market due to its small representation in the Asia Ex-Japan index whilst, Indonesia was forced to raise interest rates to maintain the stability of the Rupiah.

These markets are expected to witness easing liquidity as interest rates are cut next year in response to inflation falling back to its pre-Covid levels. The ASEAN economies we focus on have the fiscal room to support investment in areas such as infrastructure. Laying the groundwork for improving productivity and GDP growth and in turn supporting consumer confidence, which is expected to sustain at already elevated levels.

Vietnam

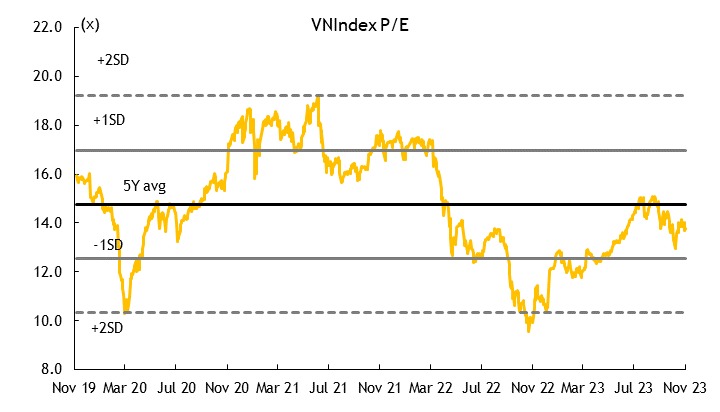

In 2023 the government’s somewhat heavy-handed policy aimed at rationalising the bond market inadvertently had a significant detrimental impact on the property market. However, subsequent actions by the authorities have clearly signalled their intent with supportive policy actions. As a result, we are witnessing the green shoots in the property market which we expect to continue in next year.Considering the growth in exports, which has turned positive year on year, we anticipate an upswing in credit demand during 2024. This trend will be further bolstered by employment gains and a boost in consumer confidence. The stock market is currently trading at a valuation in line with China, but devoid the geopolitical or structural complexities. It remains cheap relative to its ASEAN peers. Historically it has maintained an average forward multiple of approximately 14 times, signalling close to 30% potential upside should it revert to its long-term average.

Indonesia

The upcoming national elections in the first half of 2024 are poised to take centre stage. Currently, there is no clear frontrunner. However, the most likely winner would be Defence Minister Prabowo. He serves as the chairman of the Gerinda party and has selected Gabran, Jokowi’s son, as his running mate for the vice-presidency. Notably, Jokowi has subtly endorsed this pairing. Our expectation is that they will win the second round scheduled for June. In the wider context, both the candidates are continuity candidates with shared goals such as the continued development of the new capital Nusantara, increased infrastructure investment more downstream FDI for Indonesia’s abundant commodities.

Despite growth remaining in the 5% range next year, the economic landscape may shift slightly. Private investment could decrease as companies exercise caution in the first half of the year, awaiting clarity on the election outcome and associated policies. However, this potential decline in private investment is likely to be counterbalanced by increased consumption.

In election years, we typically witness a surge in government spending. This boost is directed towards election preparation, infrastructure development, and additional cost-of-living support. Consequently, consumption is expected to outpace GDP growth next year.

Furthermore, as the US dollar weakens, interest rate cuts are anticipated. These cuts will further enhance confidence levels. We also foresee stock market valuations gradually returning to historical norms.

Philippines

We expect infrastructure investment to accelerate next year as PPP projects that were held up under the previous administration start to be implemented. Furthermore, we expect that GDP growth next year will again be above 6%, outperforming this year’s mid 5% range.

In 2023, stock market returns have been disappointing. Although earnings growth has been over 20%, the market has experienced a decline. This situation has been influenced significantly by interest rates, which currently stand at 6.5%. As a result, over PHP1 trillion has been redirected into fixed income, further exacerbating the declining liquidity of the stock market. We believe inflation today has peaked and whilst the path may be bumpy, we expect inflation to fall back into the Central Bank’s target range of 2-4% next year.

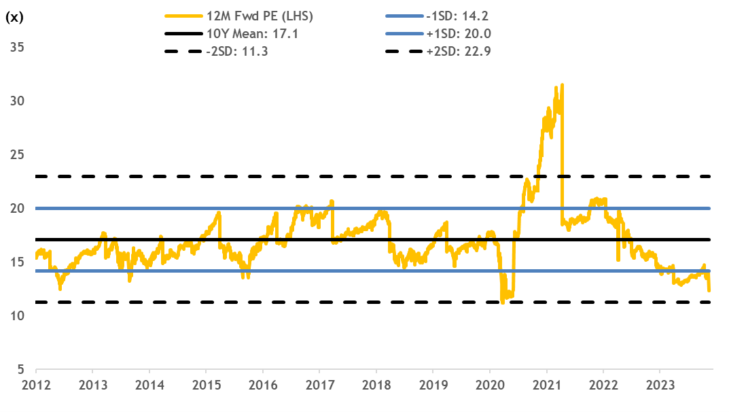

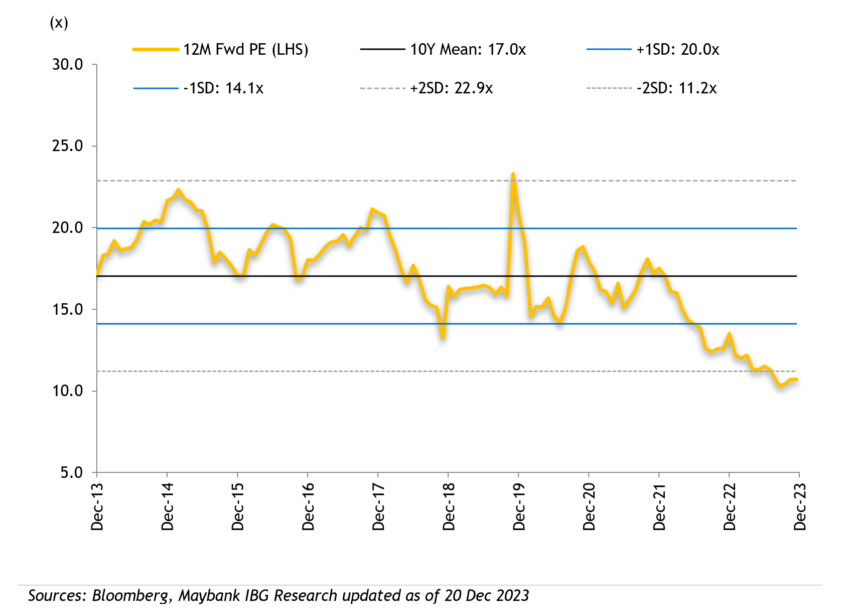

Philippine Market Forward P/E

Commencing from valuations akin to those witnessed during the global financial crisis in 2008-2009, we anticipate a resurgence of capital inflows into the equity market as interest rates are reduced. This favourable scenario is further bolstered by several factors namely, faster GDP growth, low valuations, greater liquidity and continuing eps growth. We expect the consumer names to react accordingly and expect significant upside potential for stocks.

Thailand

Thailand’s new government is resolute in revitalizing the economy. The Prime Minister’s flagship policy centres around the digital wallet, which entails distributing TBt10,000 to every individual aged 16 and above – except those with deposits exceeding TBt500,000 or earning over TBt840,000. This allocation covers 50m people and is positive for consumption, however it constitutes 2.7% of GDP and necessitates increased borrowing. Consequently, rising bond yields may ensue, given that the debt-to-GDP ratio already stands at 60%.

This could act as a handbrake on government expenditure elsewhere in areas such as fixed asset investment. Whilst this policy provides short-term benefits, it may not significantly impact Thailand’s medium-to long-term growth. As a result, we maintain a cautious outlook for Thailand and retain a single holding in the healthcare sector. Nonetheless, we anticipate higher growth and consumption in 2024 compared to 2023.

India

India will hold its national election in May next year, where the current PM Modi is widely expected to win. In the run up to election, the government is likely to increase the free food allocation under the National Food Security Act and raise the annual transfer to small farmers boosting GDP growth in the first half of 2024. Interest rate cuts are anticipated to bolster growth, given that inflation has returned to the Reserve Bank of India’s (RBI) target range. This trend aligns with developments observed in other Asian countries

India’s large domestic economy makes it less vulnerable to external shocks than other countries. The northern regions are expected to have abundant harvests this winter, thanks to the above-average water levels supporting income levels for the first half of 2024.

Furthermore, the investment cycle remains robust, evident in the rising property investments and government spending on infrastructure. The factors should ensure economic activity remains high.

India is an outlier in the sense that it is one country where we do not expect a further expansion of the market’s multiples. However, structurally the market is witnessing consistent domestic inflows, which should act as a downside support. With low-mid teens earnings growth projected for next year we expect double digit market returns to be reasonable and the PE multiple to remain stable.

Focus on Long term opportunities

Our primary focus remains on long-term shifts in consumption patterns across Asia. Our portfolio is strategically positioned to capitalize on these trends, with less emphasis on short-term fluctuations over the next six months.

Rather than speculating on macroeconomic situations or specific policy actions, we base our investment decisions on the bottom-up fundamentals of each company. Our approach centres on identifying three-to-five-year opportunities that align with our rigorous assessment of individual businesses.

To download the article as a PDF, click here.