Over the past 6 months we’ve engaged in conversations with numerous clients and a recurring theme has emerged: A growing interest in allocating funds to India. However, we believe it’s essential for investors to broaden their horizons beyond India and explore other Asian markets. While India remains an attractive investment destination, concerns about its valuation persist. As the Indian market continues to evolve, investors should consider diversifying their portfolios.

Vietnam: An Intriguing Alternative?

Enter Vietnam—a rising star in the Asian landscape. This country boasts several compelling attributes:

Robust Growth Outlook: Vietnam’s economy is on an upward trajectory, driven by factors such as a young population, increasing consumer spending, and a thriving manufacturing sector.

Foreign Direct Investment Magnet: Investors are increasingly drawn to Vietnam due to its business-friendly policies, strategic location, and competitive labour force.

Affordable Stock Market: Vietnam’s stock market offers opportunities at a reasonable value, making it an appealing prospect for investors.

Emerging Market Potential: Vietnam’s imminent upgrade to Emerging Market status is anticipated —a development that could further boost investor interest.

In summary, while India remains a solid choice, Vietnam deserves closer examination. As you evaluate investment options, consider Vietnam alongside India—it might just be the hidden gem your portfolio needs.

Is Vietnam an alternative investment to India?

Having returned from a recent trip to Vietnam, it is becoming evident that interest in the country, along with the broader ASEAN region, is on the rise. However, despite this trend, India remains the favoured market in Asia today. We wish to explore the markets further below with a view to helping clients decide where to allocate funds in Asia ver the next 3 to 5 years.

India, the established favourite: India’s growth narrative extends well into the next decade. With a large and dynamic population, a burgeoning middle class, and a robust service sector, India continues to attract investor attention. Investors are well aware of India’s potential. However, valuations have already adjusted to reflect this optimism and as a result, we believe some caution is warranted.

Vietnam, the undiscovered gem: Vietnam remains relatively undiscovered by global investors, which is surprising given its economy is thriving, driven by manufacturing, tourism and consumption and a young workforce.

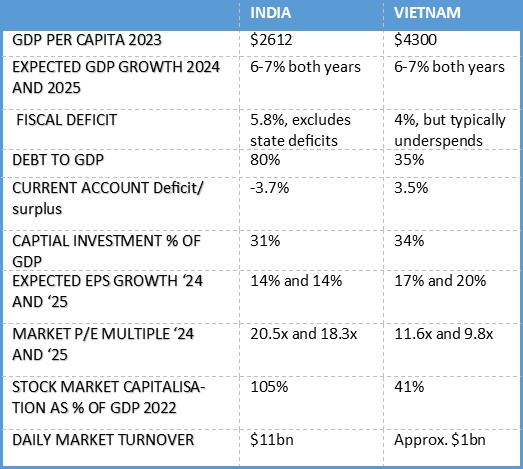

The table below outlines some basic economic statistics on each country for comparison.

Source: Bloomberg

The data paints a favourable picture for Vietnam. Whilst the country’s projected GDP growth aligns closely with other emerging Asian countries, Vietnam stands out with its robust balance sheet and prudent fiscal policies and healthy current account.

Healthy Deficit: Vietnam’s prudent management of its finances translates into a more sustainable economic trajectory.

Debt-to-GDP Ratio: Despite experiencing rapid growth during the Covid period, Vietnam’s debt-to-GDP ratio has consistently declined. This is a remarkable feat, especially when contrasted with other nations. Currently standing at 35%, Vietnam’s debt-to-GDP ratio remains manageable. Even with a planned 4% fiscal deficit, the overall debt burden is expected to decrease as a percentage of GDP. This favourable position provides ample room for Vietnam to ramp up infrastructure investments without compromising fiscal stability.

Both Vietnam and other countries are actively investing in capital projects. Their governments share a common goal: Driving sustained economic growth.

In summary, Vietnam’s prudent fiscal management positions it well for future endeavours. As we evaluate investment opportunities, let’s keep an eye on this dynamic nation alongside its peers.

India, urban resilience and consistent growth.

Unlike Vietnam, India isn’t emerging from a depressed economic state. Instead, it has maintained consistent growth throughout 2022, 2023, and early 2024.The urban consumer remains robust, driving spending. Personal loans have surged at an impressive 25% annually.

Property cycle has legs: The property cycle, initiated a couple of years ago, continues unabated. Major property companies trade well above their net asset values (NAVs). Similar to Vietnam and other ASEAN nations, India faces an undersupply of high-quality urban properties. This scarcity suggests that the property cycle can extend for several more years

Are we at the start of a new private capex cycle?

India awaits a surge in private capital expenditure (capex). This could be the catalyst for sustained growth post the upcoming election. Rural India holds the key. Despite challenges post-Covid, rising real wages could fuel a rebound, complementing the urban consumer’s credit-driven spending.

In summary, India’s economic narrative is multifaceted—a blend of urban resilience, rural aspirations, and the promise of private investment.

Contrasting stock markets

When it comes to stock market dynamics, India and Vietnam exhibit distinct features.

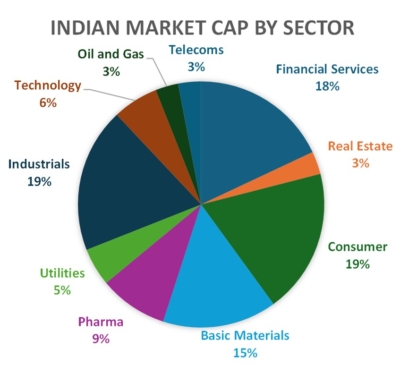

India, vast and diverse:

India’s stock market is expansive, offering a plethora of investment opportunities. It houses a multitude of companies across various sectors.

Financials play a significant role, constituting approximately 18% of the Indian market index.

Vietnam, financials heavy: The financials sector takes centre stage comprising a substantial 40% of the market index. This lack of breadth can limit investment opportunities.

In Vietnam, banking stocks often trade at a discount compared to other sectors. Notably, the average price-to-earnings (PE) ratio for banks stands at 7.9x, and the price-to-book (P/B) ratio hovers around 1.6x. At first glance, one might assume this discount results from poor return on equity (ROE), sluggish growth, or a troubled historical track record. However, the reality tells a different story.

Strong Fundamentals

ROE Resurgence: Over the past 5 to 10 years, Vietnam’s banks have demonstrated robust performance. The average ROE now approaches 20%, signalling healthy profitability.

Earnings Momentum: Expect earnings growth to continue in the high teens throughout 2024 and 2025.

Resilience Amid Challenges: Despite navigating the Covid pandemic and a property downturn, major Vietnamese banks have maintained their financial stability. Balance sheets remain robust, and lending capacity remains intact.

The discount observed in Vietnam’s banking sector is not reflective of underlying weaknesses. Instead, it presents an opportunity for investors to explore this undervalued segment with confidence.

Source: Axis Capital and Viet Securities

Source: Axis Capital and Viet Securities

What is fair value?

India: A Deep and Liquid Market: India’s stock market is well-established, providing an alternative investment avenue for global investors seeking diversification beyond China. Strong domestic inflows further bolster India’s appeal.

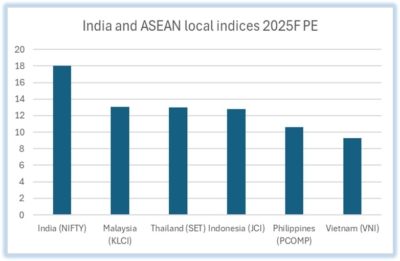

India’s re-rating journey over the past 5 to 10 years has been significant. Currently, its two-year forward price-to-earnings (PE) multiple stands at 18.3x, nearly double that of Vietnam. But how do we determine the right discount for Vietnam compared to India? The answer lies in subjectivity; Vietnam operates as a frontier market, characterized by unique challenges. Limited investible stocks, foreign ownership restrictions, and lower liquidity are factors that warrant a discount.

Source: Bloomberg

While acknowledging these differences, should India trade at almost double Vietnam’s valuation when over the medium term, their economic growth outlooks look to converge?

Vietnam: The Frontier Market with Potential: Vietnam operates as a frontier market, characterized by unique features. Prefunding requirements and foreign ownership restrictions impact trading in Vietnam.

Domestic investors dominate daily liquidity, often engaging in short-term margin trading, contributing to market volatility. Vietnam aspires to transition from a frontier market to an emerging market. The Vietnamese government’s efforts may lead to FTSE upgrading its status in the second half of 2025, followed by MSCI in 2026. This shift will attract international investors, especially given Vietnam’s rapid development trajectory, akin to China’s historical growth.

Despite having the fastest growth outlook and strong macro prospects, Vietnam trades at a significant PE discount compared to other ASEAN markets. As Vietnam deepens ties with the US, Japan, and South Korea, and focuses on technological advancements, its valuation dynamics may evolve.

We also see markets such as Indonesia and the Philippines as undervalued today. A fairer forward PE multiple for fast growing ASEAN markets might see a return to the 15x + they traded at pre Covid offering attractive upside for longer term investors.

Conclusion

Over the next three years, Vietnam is poised for robust earnings growth as its economy rebounds. As Vietnam ascends to Emerging Market status,. We anticipate a potential 30% rerating. While risks exist, the rewards appear promising.

India, although not cheap, benefits from strong domestic inflows. However, it’s unlikely to witness significant multiple expansion from here. These elevated valuation levels may well persist, supported by the domestic flows. However, at this price we believe the good news is well known and we see more attractive risk reward elsewhere in the region.

Author: Lead Portfolio Manager – Andrew Williamson-Jones

For more information please contact Francis Horn, Email: fh@hgamuk.com

To download the article as a PDF, click here.