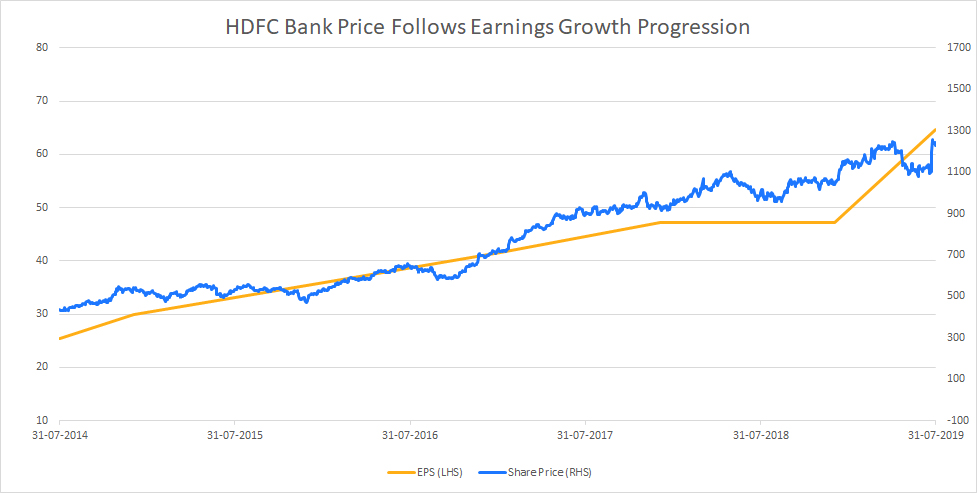

We believe that in the long run a company’s earnings growth is correlated to its share price.

So it is EPS and dividend growth that will ultimately deliver shareholder returns. There will always be bouts of volatility driven by fear and greed but in the long run equity returns should mirror compounded earnings.

As can be seen in the chart the earnings of HDFC Bank, the leading Indian private retail lender, are up some 130% over a 6 year period. The share price has also produced similar returns.

Share price, in the short term can deviate from the earnings trend, particularly if a market becomes too enthusiastic or bearish, but in the long term correlation between share price and earnings tends always to remain strong.

Source: Thomson Reuters

We aim to deliver a total annual return (gross of fees) of 8-12%*

* Risk Warning: The Fund is subject to normal stock market fluctuations and other risks inherent in such investments. Past performance is not a guide to future returns. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. You should therefore regard your investment as a medium to long term investment.